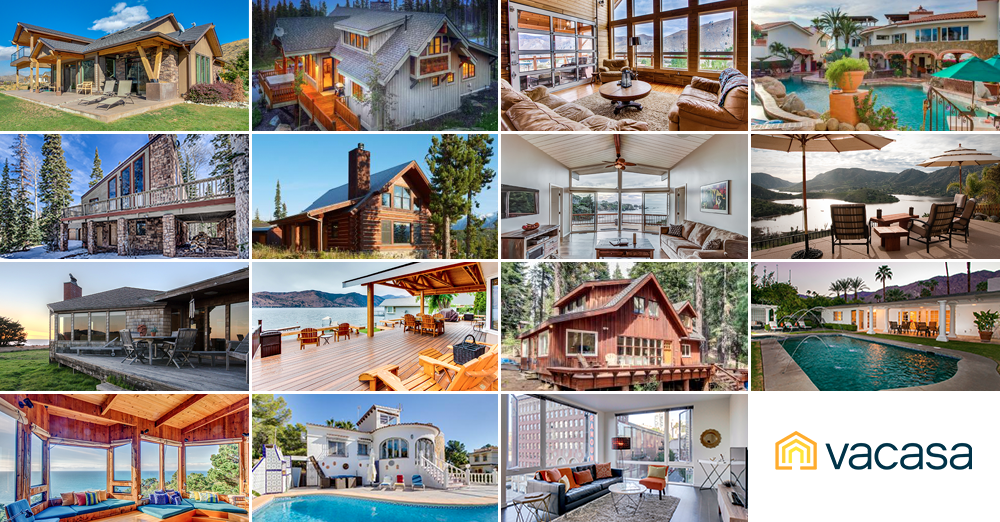

Matchless Info About How To Afford A Vacation Home

Depending on the price of your property and the criteria of your lender, a down payment of 20 percent or more may be necessary for.

How to afford a vacation home. Buy for as little as 20 percent down, and qualify for the loan using your full primary residence cost plus your full second home cost. Buying a vacation home is an extremely important decision that comes with large expenses. Breakeven or cashflow positive, covering your monthly costs or.

While it varies by lender, according to darnell, conventional mortgage programs that might typically need only 3% down on a primary residence will require a minimum of 10%. Mortgage rates and tax benefits are the same. Once you’ve decided to go ahead with the purchase, the very next step should be.

While primary home loans can be obtained with as little as 3% down, expect to have to put at least 10% down on a vacation home. Determine your financial objectives one of the most important considerations when purchasing a second. Once you’ve decided to go ahead with the purchase, the very next step should be.

Buying a vacation home is an extremely important decision that comes with large expenses. Unless you are paying cash, a 25% to 35% or even 50% down payment may be required to secure a second or third property beyond your primary home, especially if its price. Calculate your monthly income and debt monthly employment income (before taxes)* other monthly income aggregate.

How much vacation home can i afford? Such a property will be far more likely to “flow” i.e.