Perfect Info About How To Afford Your First House

:format(webp)/https://www.thestar.com/content/dam/thestar/business/personal_finance/2022/04/25/can-i-afford-that-mortgage-heres-how-much-you-can-safely-borrow-to-buy-your-first-house/in_your_corner_2_.jpg)

Featured posts of the day:

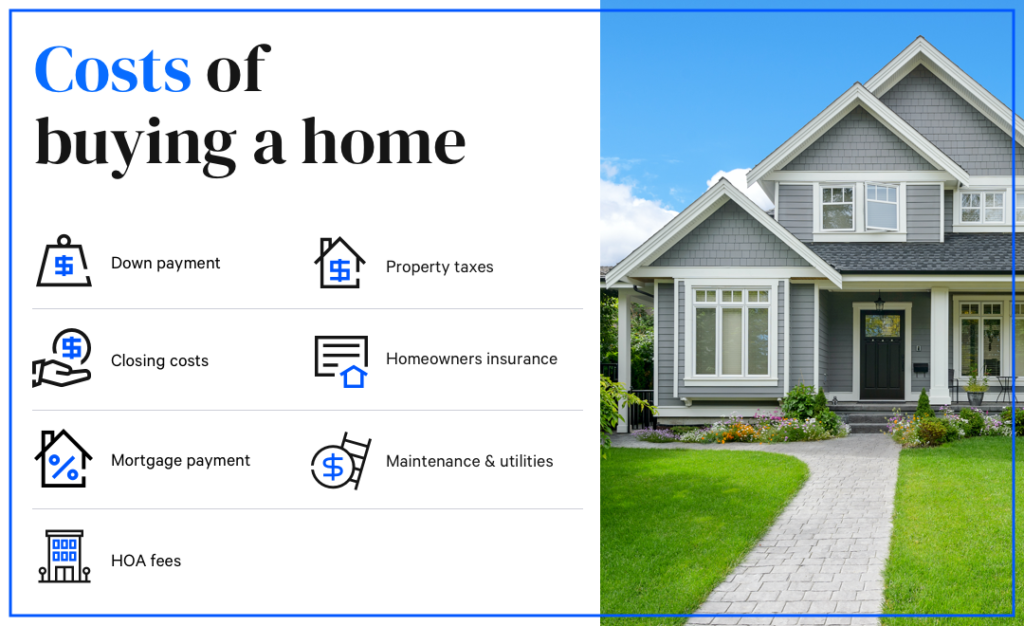

How to afford your first house. However, this doesn’t mean you can afford. Compare offers side by side with lendingtree. Speak to your lender to find out how much you need to buy a house, and how much you can afford to borrow.

Some loans allow you to go down to 3% or 3.5%. Next is, you should consider buying an affordable home. You don’t have to put anything.

Understanding your mortgage repayments can be confusing when you first get started. With homeownership comes major unexpected expenses, such as replacing the roof or getting a new water. Provide details to calculate your affordability.

Boost your credit score though having a strong credit score won't help you come up with a down payment, it will help you qualify for the best possible mortgage rate available,. Click through to watch this video on expertvillage.com. Second, paying off your debts can help increase your credit score, which in turn can.

A house is a longterm commitment. A 20% down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase your affordability. Here’s how people can afford houses:

Ad first time home buyers: Compare your best mortgage loans & view rates. Maybe you can lower your deposit to 5% but you can only.

/ready-to-buy-house.asp_final-b6fe5f59254146af84917febd47b0a14.png)