Fine Beautiful Tips About How To Improve Low Credit Score

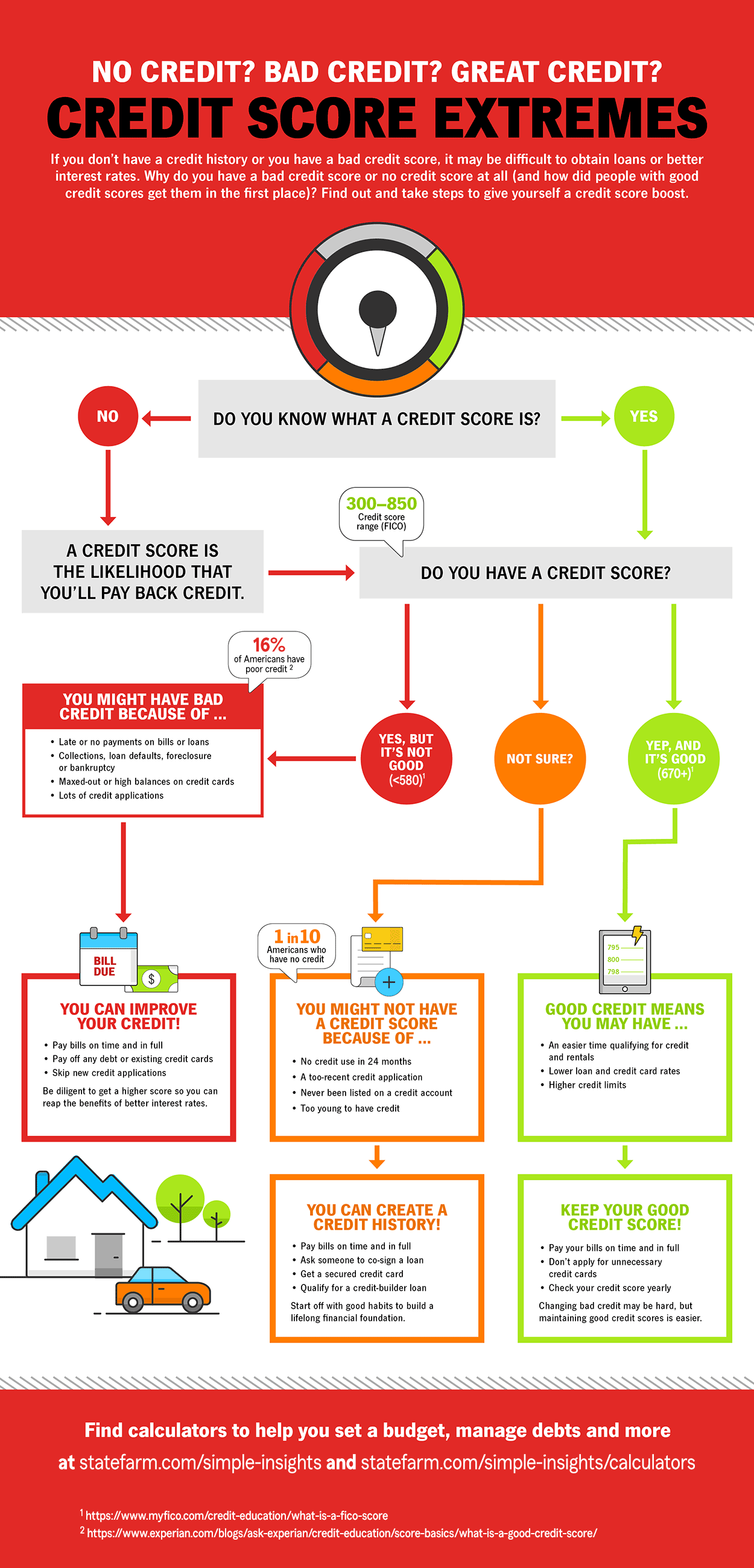

Maintaining a good credit score can get you access to loans and new lines of credit at favorable rates.

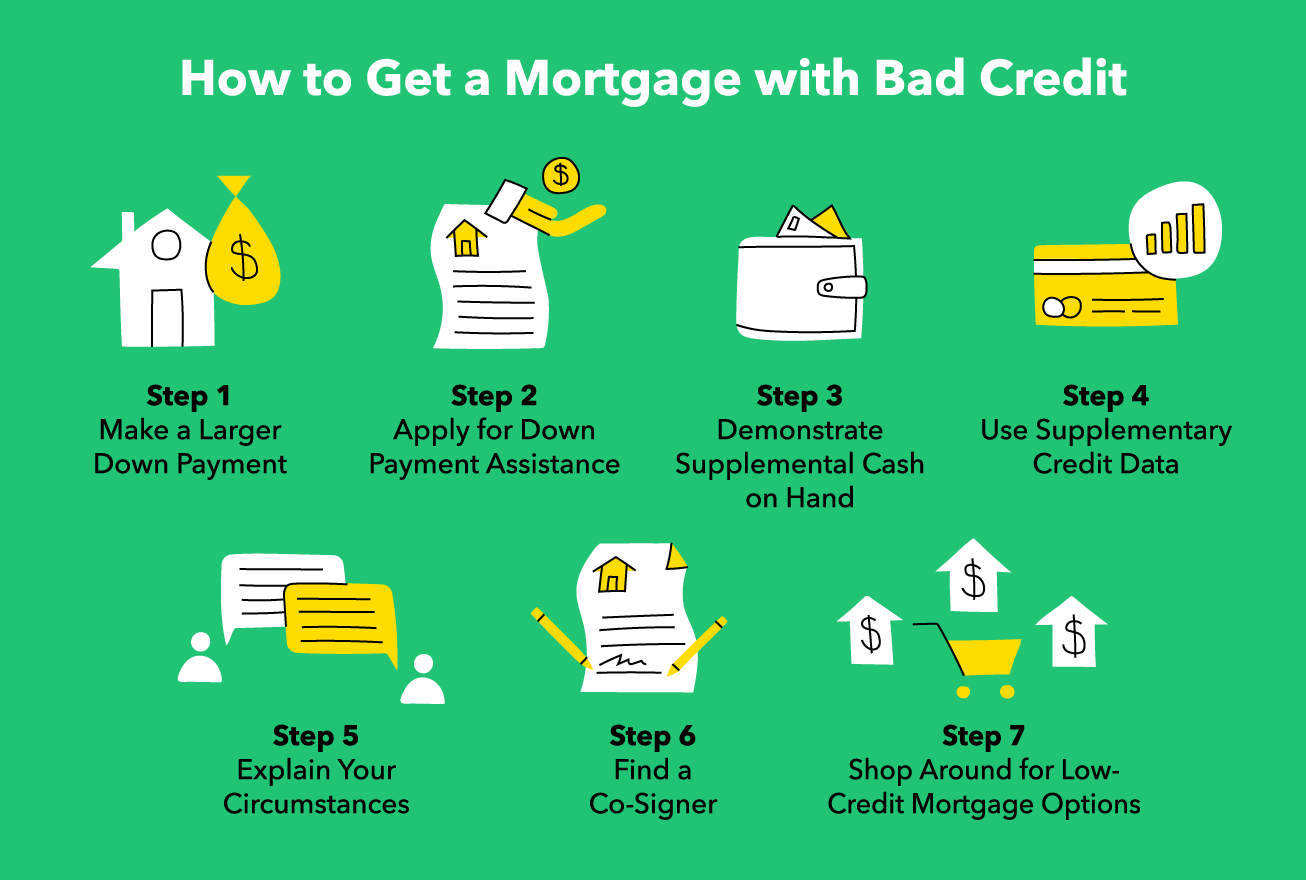

How to improve low credit score. Find a card with features you want. Try not to open any new credit card accounts that aren’t necessary. Get ready for the shocker:

That is, you should maintain a balance of no more than $3,000 on a credit card with a limit of. The most surefire way to raise your credit score is to pay your bills on time. It may feel impossible to escape from bad credit history though, so we at the home.

Ad responsible card use may help you build up fair or average credit. Whether it’s student loans, credit cards, mortgages, or a combination, you want to make sure. 1 hour agothe study also noted that boosting your credit score has the largest impact on home mortgage costs.

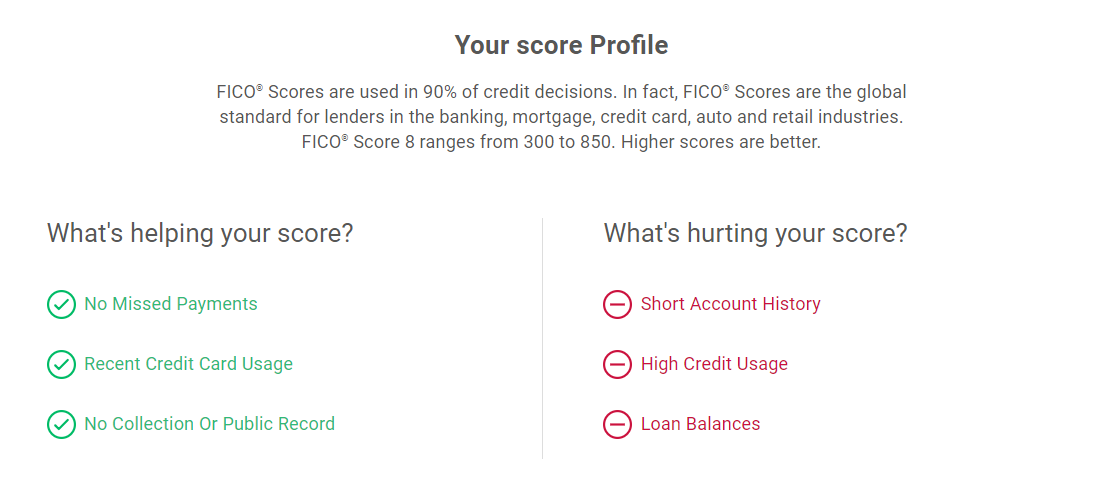

Stay focused to improve your credit. Here are five tips that could help you increase your chances of a credit card approval. Check your credit report for errors.

The fastest ways to increase your credit score include paying bills on time, becoming an authorized user, increasing credit limits without increasing your balances, and. Find a card with features you want. Normally the longer your payment history on an account, the better your credit score will be.

However, if you absolutely have to carry a balance, you should aim for a target. Improve your fico® score & get credit for the bills you're already paying. It takes time to improve your credit, and can be challenging on a low income.

:max_bytes(150000):strip_icc()/common-things-that-improve-and-lower-credit-scores2-f5cf389fdf4f46579ddcc49d8db40525.png)

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)