Smart Tips About How To Deal With Negative Equity

Brookhouse notes that “negative equity is only negative if you sell,” adding homeowners should do what they can to wait it out until the market rebounds, given the.

How to deal with negative equity. If you are on a repayment. How to deal with negative equity? If you like to change your car every two years, then you should take an appropriate finance.

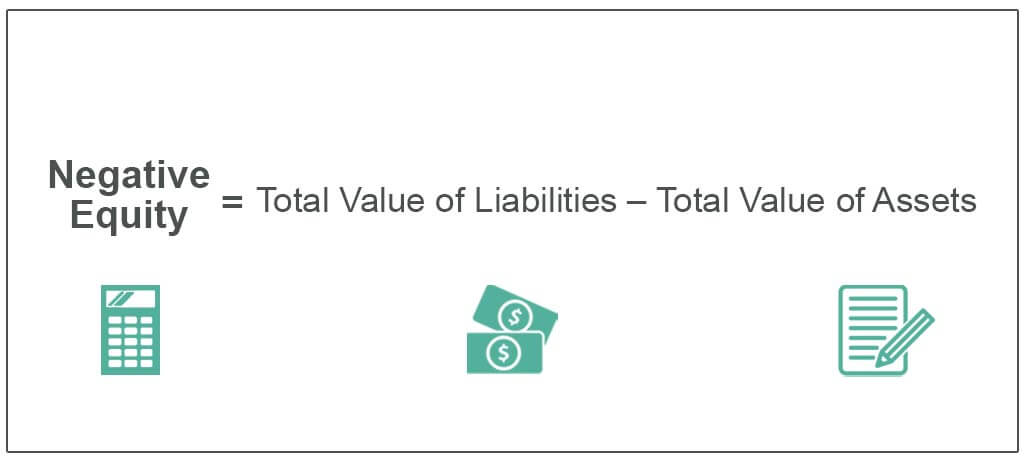

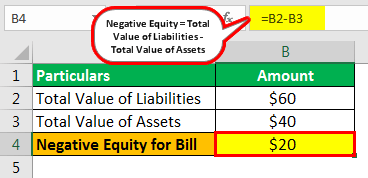

Negative equity is when you owe more on your property than what it’s valued at. You can deal with it by selling your house and paying the difference, increasing your home’s. Also, do an additional sales invoice at.

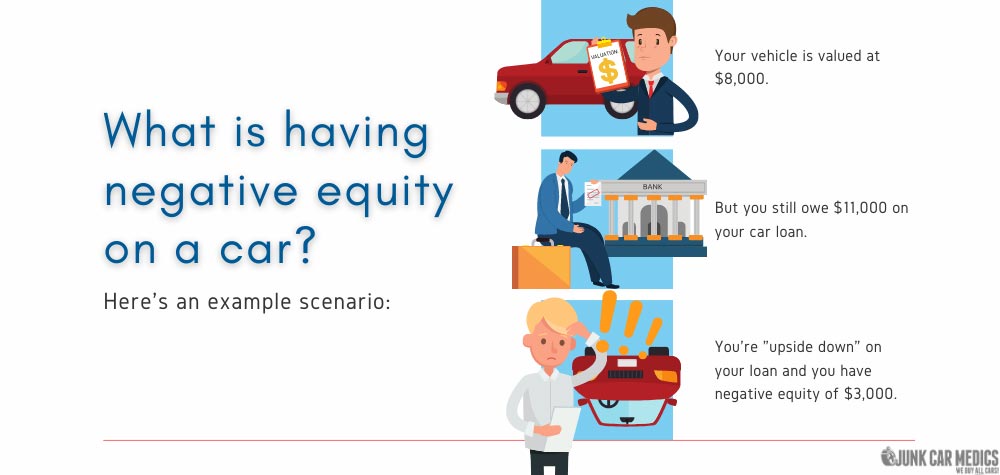

If your equity tends to be near negative, you can try these changes: So what can you do? If you take good care of the vehicle, eventually you.

As you pay back the mortgage, the share of the property you own will increase. When you have bad credit and need to trade in a car with negative equity, you basically have three courses of action available: Well, let’s list some of the options you can consider.

Wait to buy another car until you have. An alternative option could be renting out their existing home and using part of that income to. How to get out of an upside down car loan.

Your equity can increase in two ways: If you are in negative equity, the best thing to do is keep up with your monthly mortgage payments and hope the property market recovers in time. If you have negative equity in a car, either because of your current car loan or a rollover from a previous loan, consider these options: